Let's be honest, an event budget is more than just a spreadsheet of numbers. It's your financial game plan. It’s what keeps your vision grounded in reality and ensures every penny you spend pushes you closer to your goals. Think of it as the blueprint that prevents costly surprises and helps you make smart decisions from day one.

Laying a Realistic Financial Foundation

Before you even think about booking a venue or hiring a caterer, you need to build this financial blueprint. This is where your event goes from a cool idea to a workable plan. Getting this right from the start is the best way to avoid that sinking feeling when unexpected costs pop up later.

It all starts by tying your budget directly to what you're trying to achieve. Are you hoping to bring in new sales leads? Or maybe you're celebrating a huge team accomplishment? Your answer changes everything about where the money should go.

✦Define Your Event Goals and Priorities

Your event's "why" is the single most important factor in your budget. A laid-back team-building retreat has a completely different price tag than a high-stakes product launch. To figure this out, you need to ask some tough questions to separate the essentials from the nice-to-haves.

- What's the primary goal? Are you trying to boost team morale, drive sales, or get your community excited?

- Who are you planning this for? Your own team will have different expectations than C-level executives or paying customers.

- What kind of experience do you want to create? A premium, unforgettable experience is going to demand a much bigger investment in things like production value and venue choice compared to a simple, casual get-together.

Going through this exercise forces you to prioritize. For example, if you know that networking is the most important outcome, you’ll probably want to spend more on a centrally located, comfortable venue with great food, and maybe less on fancy decorations.

A clear goal is the bedrock of a smart event budget. It stops you from just spending money and turns every dollar into a strategic investment with a real return.

✦Streamline Planning for Internal Events

If you're planning an event for your own team, especially in a company that relies heavily on Slack and Google Calendar, you know how quickly the logistics can spiral. You're probably juggling Slack messages, Google Calendar invites, and a messy spreadsheet for RSVPs. All that manual work is not just a headache; it's a hidden cost that drains your team's time and energy.

This is where a simple tool can make a huge difference. For instance, Be There is particularly useful for companies who use both Slack and Google Calendar internally, as it plugs right into these existing tools. It automates the whole process of inviting people, tracking who's coming, and sending out reminders directly within the workflow your team already knows.

Instead of bouncing between different apps, you can handle everything in one spot. This efficiency is a direct saving, freeing up your people to focus on the creative side of planning instead of getting bogged down in administrative work. You get a smoother process, better attendance, and you protect your budget for the things that really impact the attendee experience.

Mapping Out Your Core Event Expenses

Once you’ve got a handle on the big picture, it’s time to get into the nitty-gritty of your spending. Budgeting an event means going deeper than just the obvious line items like the venue and catering. The real trouble often comes from the hidden costs—the little things that seem minor on their own but can derail your entire budget.

I’m talking about things like payment processing fees for ticket sales, special event permits from the city, or the cost of security staff. Even details like overtime pay for your A/V crew or mandatory event insurance can add up fast. The only way to avoid nasty surprises is to create a detailed, line-by-line breakdown of every single possible expense.

✦Breaking Down the Major Costs

To really get an accurate picture, you need to dissect your event into its core spending categories. It helps to look at where the money typically goes in the industry. For instance, recent data for U.S. conferences in 2024-2025 shows that Food and Beverage (F&B) is the single largest expense, eating up nearly 30% of the total budget. Right behind it is Audio/Visual (A/V), which comes in at around 15%.

Here are some of the main categories you'll definitely need to budget for:

- Venue Rental: This is often your biggest fixed cost. When you're getting quotes, always ask what's included. Tables, chairs, basic lighting, and staff aren't always part of that initial price tag.

- Food and Beverage (F&B): A classic variable cost tied directly to your attendee count. Make sure your quotes are on a per-person basis and clarify if service charges and taxes are baked in.

- Audio/Visual (A/V) and Production: Don't skimp here. This bucket covers everything from microphones and speakers to projectors, screens, and the skilled technicians you need to make it all run without a hitch.

- Marketing and Promotion: How are you getting the word out? This includes digital ads, email marketing, social media campaigns, and any printed flyers or banners. This ties directly into your overall event marketing plan.

- Staffing and Labor: This covers your on-site event staff, security, A/V techs, and any fees for speakers, hosts, or entertainers.

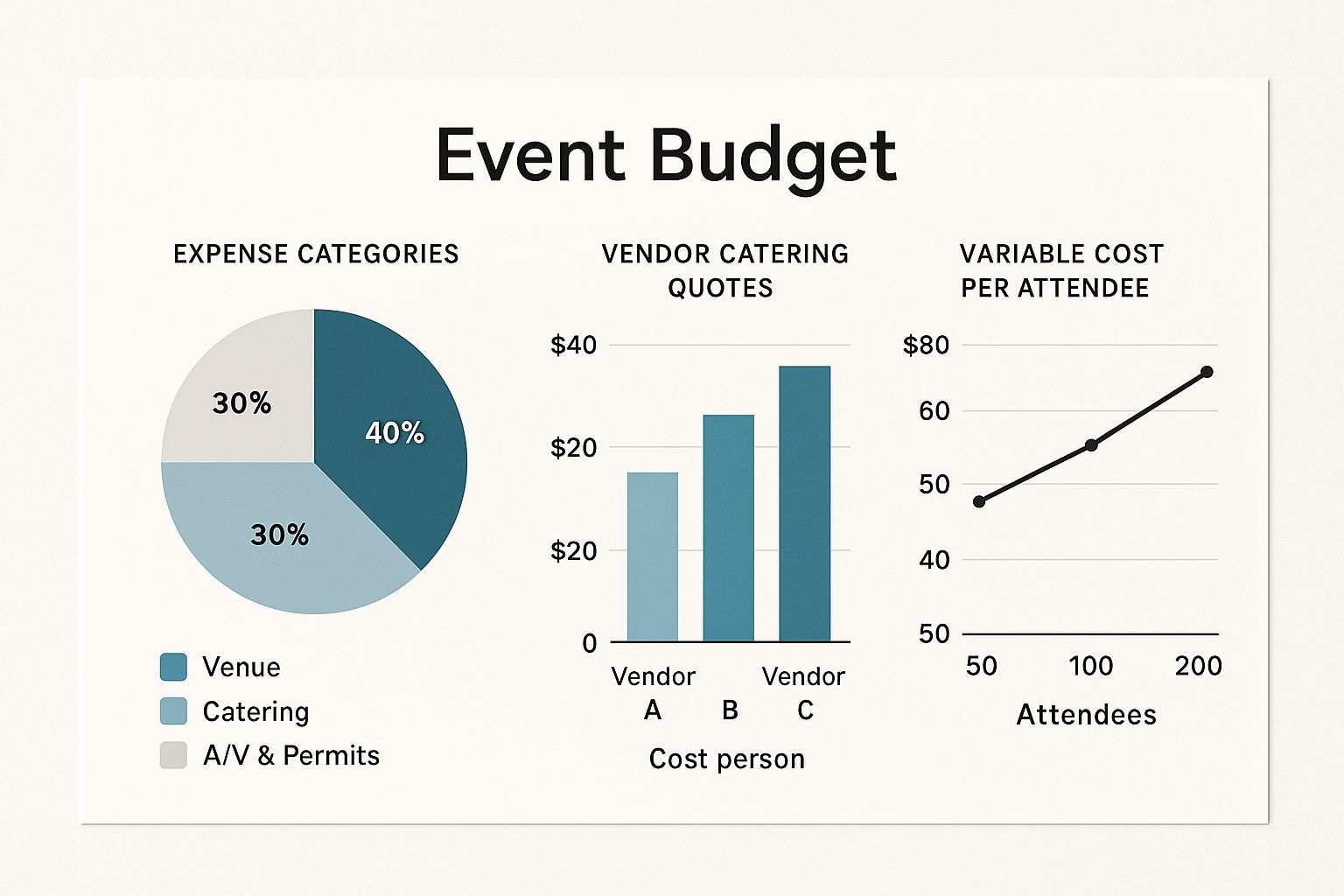

This infographic gives a great visual of how these expenses can stack up and how certain costs fluctuate with attendance.

As you can see, getting multiple quotes from vendors is non-negotiable, as is understanding exactly how your costs will scale as more people RSVP.

To help you get started, here's a table with some typical budget allocation percentages based on industry benchmarks.

✦Typical Event Budget Allocation Percentages

| Expense Category | Average Percentage of Budget |

|---|---|

| Venue Rental | 20-25% |

| Food & Beverage (F&B) | 25-30% |

| A/V & Production | 10-15% |

| Marketing & Promotion | 5-10% |

| Speakers & Entertainment | 5-10% |

| Staffing & Labor | 5-10% |

| Miscellaneous & Contingency | 10-15% |

Keep in mind that these are just averages. Your own event's percentages might look quite different depending on your goals and priorities.

✦Streamlining Internal Event Coordination

If your company runs on Slack and Google Calendar, you know how messy internal event planning can get. Manually tracking RSVPs, sending out calendar invites, and posting constant reminders across different channels is a huge time sink—a hidden cost that rarely makes it onto a spreadsheet.

A tool that automates this workflow isn't just a nice-to-have; it's a direct budget-saving measure. By slashing administrative hours, you free up your team to focus on bigger things, like negotiating better rates with vendors or enhancing the attendee experience.

This is exactly where a tool like Be There becomes incredibly handy for companies that use both Slack and Google Calendar. It's built specifically for this environment, automating the entire invitation and RSVP process. Instead of your team spending hours chasing people down and updating lists, the tool does the heavy lifting within the platforms you already use daily. That efficiency boost translates into real savings, letting you put that budget toward things your attendees will actually notice and appreciate.

How to Actively Manage Your Event Budget

So, you've built a beautiful, detailed budget. That’s a great first step, but it’s just that—a first step. A budget isn't a "set it and forget it" document you can just file away. It’s your financial roadmap, and you need to be looking at it constantly to make sure you're still on course.

This is what separates the pros from the rookies. Proactive budget management turns a stressful, surprise-filled planning process into a smooth, controlled one. Think of your budget not as a static spreadsheet but as a live dashboard showing the financial health of your event at any given moment.

✦Set Up a Central Tracking System

First things first, you need a single source of truth for every dollar spent. Whether it's a shared Google Sheet, a board in Asana, or a dedicated event platform, the tool itself isn't as important as how you use it. Everyone on your team needs to be logging expenses in the exact same place.

A central system stops the chaos before it starts—no more confusion, no more accidentally paying the same invoice twice. As soon as a cost is approved or an invoice is paid, it gets logged. Immediately. This is the only way to make smart, informed decisions on the fly.

A budget that isn't updated in real time is just a historical document. Active tracking transforms it into a powerful decision-making tool that prevents overspending before it happens.

✦Define a Clear Approval Process

One of the quickest ways to blow your budget is rogue spending. You need a simple, clear workflow for approving expenses. It doesn't have to be some bureaucratic nightmare; it can be as simple as requiring a sign-off from the event lead for any purchase over $500.

For teams already juggling multiple internal tools like Slack and Google Calendar, adding another layer of approvals can feel like one more thing to manage. Communication gets messy and things fall through the cracks.

This is where a tool like Be There can indirectly help. It’s built for companies that live in that Slack and Google Calendar world, centralizing event communication by automating RSVPs and reminders. While it's not a budgeting tool, the clarity and streamlined communication it provides helps keep everyone aligned—a key part of effective event planning project management. When the team is in sync on logistics, it’s much easier to maintain financial discipline.

✦Get a Handle on Your Cash Flow

Tracking expenses is one thing, but understanding cash flow is a whole other ball game. You absolutely have to know when big payments are due so you can make sure the money is actually there. It’s easy to forget that a venue might demand a 50% deposit six months before the event, long before a single ticket has been sold.

To stay on top of this, map out a clear payment schedule. I recommend including:

- Vendor Due Dates: Note every deposit and final payment deadline.

- Sponsorship Payouts: When are you actually getting that sponsorship money?

- Ticket Sale Projections: Create a realistic timeline for when you expect revenue to start coming in.

Lining up your outgoing payments with your incoming cash prevents awkward crunches and keeps your vendors happy. The final piece of the puzzle? Regular budget check-ins. Get your team together weekly or bi-weekly to review everything. It keeps everyone accountable and allows you to pivot quickly if needed.

Using Smart Tools to Protect Your Budget

Manual work is the silent killer of any event budget. In today's world, time really is money. Every hour your team spends buried in administrative tasks is an hour they can't spend negotiating better deals with vendors or actually improving the experience for your attendees. This is a huge deal, especially when you're planning internal events.

Too many teams get stuck in a frustrating cycle of Slack announcements, last-minute Google Calendar invites, and messy RSVP spreadsheets. This isn't just annoying—it's a massive hidden cost. It eats up precious staff hours that could be focused elsewhere, which directly hits your bottom line.

✦The Hidden Cost of Manual Coordination

Just think about organizing a quarterly team offsite. The planner posts in a company-wide Slack channel, then has to manually create a calendar invite for everyone. As people slowly respond (or don't), the planner wastes hours chasing them down, cross-checking lists, and updating a master spreadsheet.

This mess creates a few big budget problems:

- Wasted Staff Hours: All that time spent on manual follow-up is a direct labor cost that almost never makes it into the initial budget.

- Inaccurate Headcounts: A clunky, slow RSVP process means you never have a firm number for catering or the venue, which almost always leads to overspending.

- Lower Engagement: If the invitation process is a headache, people are less likely to come. A drop in attendance means the ROI for the whole event takes a hit.

The biggest drain on an event budget isn't always an expensive vendor; it's the slow, creeping cost of inefficiency. Automating the repetitive stuff is one of the smartest moves you can make to protect your budget.

✦Streamlining Your Workflow with Integrated Tools

This is exactly where a tool like Be There comes in handy for companies who use both Slack and Google Calendar internally. Instead of bouncing between different apps, it brings the entire invitation, reminder, and RSVP process into one automated workflow right where your team already communicates.

You can see just how simple it is to create a full event announcement, with all the necessary details, right from inside Slack where your team already is.

When you automate this process, you stop chasing down responses and free up your team to focus on the strategic work that really matters. That efficiency turns directly into cost savings, better attendance, and a much higher return on your event investment.

On top of event-specific platforms, it’s also a good idea to have a solid system for tracking your spending in real-time. To keep things simple and prevent overspending, look into some of the top business expense tracking apps that let you monitor costs as they happen. These tools give you the clear visibility you need to stay on track and make smart financial decisions from start to finish.

Finding Savings and Planning for Surprises

No matter how perfectly you map out your budget, something will always come up. It's just the nature of event planning. Maybe a key vendor suddenly raises their prices, or ticket sales start slower than you’d hoped. The trick isn't trying to predict every little thing—it's building a budget that can take a hit and actively hunting for smart ways to save money from the start.

Your first line of defense is a solid safety net. I'm talking about a contingency fund, and this isn't optional. It’s the financial cushion that absorbs the shock of the unexpected. I always recommend setting aside 10-20% of your total budget for this. It might seem like a lot, but it’s worth it.

Think of your contingency fund as event insurance. You hope you don't need it, but if something goes wrong, you'll be incredibly glad it's there. It's the one thing that stands between a minor hiccup and a full-blown budget crisis.

✦Building Your Financial Buffer

Getting buy-in from stakeholders for a contingency fund can sometimes be tricky. The key is to frame it as a strategic move for managing risk, not just extra spending. I usually explain that it’s there for essential but unplanned costs—like needing more security guards at the last minute or a sudden jump in what your AV supplier is charging for equipment.

Once you have that buffer secured, you can get creative with finding savings without cheapening the event experience. It's not about picking the lowest price; it's about getting the best value for every dollar.

✦Creative Ways to Reduce Event Costs

Trust me, there are always ways to trim expenses if you know where to look. Small adjustments can free up a surprising amount of cash that you can then put toward things that directly impact your attendees, like better speakers or more networking opportunities.

Here are a few tactics I’ve used successfully over the years:

- Negotiate with Vendors: Never accept the first quote. You can often get a better deal by offering a larger upfront deposit or showing them the potential for future gigs. A little friendly negotiation goes a long way.

- Choose Off-Peak Dates: Simply moving an event from a Friday to a Tuesday can slash your venue rental and even your attendees' travel costs.

- Go Digital with Materials: Forget printing thousands of programs. A mobile event app is a modern, sustainable alternative that saves a ton of money on printing and shipping.

- Leverage Sponsorships: Think beyond cash. Ask a local brewery to sponsor a happy hour or a coffee shop to cover the morning break. In-kind sponsorships are a fantastic way to cover major expenses. For more ideas on creating sponsor-worthy value, check out our guide on https://be-there.co/blog/articles/how-to-increase-event-attendance.

It also pays to look into modern strategies for cutting spending and adopting flexible pricing models. Finding these hidden efficiencies is what separates the pros from the amateurs. The goal is to make every dollar work harder for you, so you can handle any curveballs and still pull off an amazing event.

What to Do After the Event: Turning Your Budget into a Blueprint

The event's over, the lights are off, but your work isn't quite done. This is where the real learning begins. Now you get to turn this event’s budget into a roadmap for the next one. It’s not just about seeing if you came in under or over; it's about digging into the why.

Your first job is a full budget reconciliation. That means lining up every single projected cost against the final invoice. Did the AV vendor’s final bill have a surprise fee? Did you overestimate how many people would show up, leaving you with way too much food? Answering these questions now is what makes your next budget smarter and sharper.

✦Connecting the Dots: Costs vs. Goals

The real litmus test for your budget is the event's return on investment (ROI), but that's a lot more than just profit and loss. You have to tie your final spending back to the goals you set in the very beginning.

If your main goal was generating new leads, what was your final cost per lead? If it was a team-building event, can you see a bump in employee engagement scores? This is the kind of data-driven review that separates the pros from the amateurs. It turns your budget spreadsheet from a historical document into a strategic tool.

The point of a post-event review isn't to point fingers for going over budget. It’s about finding patterns and learning lessons that make every event you plan from here on out more successful.

✦Spotting Hidden Costs and Planning for Efficiency

While you’re digging through the numbers, keep an eye out for the hidden costs. The big one is almost always your team's time. Think about how many hours your team spent just managing the logistics for an internal event. If your company lives in Slack and Google Calendar, you know the pain of sending invites, chasing down RSVPs, and firing off reminders.

This is a real labor cost that almost never makes it onto a standard budget, but it absolutely hits your bottom line.

This is where a little automation can make a huge difference. A tool like Be There, for example, is very useful here as it plugs right into your existing Slack and Google Calendar workflow. It takes all that manual, time-sucking communication work off your team's plate.

When you bring in a tool like that, you're not just buying software; you're buying back time. You're cutting down the staff hours needed to run the event, which is a real, repeatable cost saving. It helps you build a future budgeting an event plan that’s lean and focused on creating value, not just managing busywork. With the events industry projected to hit $2.5 trillion by 2035, getting this level of efficiency right is no longer a nice-to-have—it's essential. Discover more insights about these industry trends.

Ready to get rid of the hidden costs that come with manual event planning? With Be There, you can automate your whole internal event process right inside Slack and Google Calendar. Start your free trial and see just how much time—and money—you can get back. Learn more at https://be-there.co.

Planning your internal events has never been easier!

No more scheduling headaches—our Slack-connected web app keeps things simple. Less email, more fun! 🚀