Think of your event budget as less of a spreadsheet and more of a strategic roadmap. It’s not just about tracking expenses; it’s about making sure every single dollar you spend is pushing you closer to your main goal.

Aligning Your Event Goals with Your Budget

Before you even think about vendor quotes or line items, you need to be crystal clear on one thing: what's the point of this event? A budget without a goal is just a list of costs. A budget tied to a clear objective becomes a powerful tool.

What does success look like for you? Are you trying to pull in new sales leads? Maybe you're launching in a new city and need to make a splash to build brand awareness. Or perhaps it's an internal event, and the real goal is to re-energize your team after a tough quarter. Each of these goals completely changes where your money should go.

- For Lead Generation: You'll want to invest heavily in things that attract and capture your ideal customer. Think about a top-tier keynote speaker, smart networking tech, and a laser-focused digital marketing campaign.

- For Brand Awareness: Your budget should lean into visual impact. A stunning venue, high-quality branding everywhere, and a solid social media campaign will be your best friends.

- For Team Morale: The focus shifts to the experience. This is where you spend on unique team-building activities, incredible food, and entertainment that gets people talking for weeks.

✦Research and Realistic Planning

Once you know why you're spending the money, it's time to figure out how much you'll need. Don't just pull numbers out of thin air. Your best starting point is looking at similar events your company has run in the past. What did you budget versus what did you actually spend? That historical data is gold.

If you’re starting from scratch, get on the phone. Reach out to venues, A/V companies, and caterers for preliminary quotes. At the same time, map out your potential income. Will there be ticket sales? Sponsorship tiers? These revenue streams are a critical part of the equation. Getting this full financial picture is the foundation for building a solid event marketing plan that you can actually execute.

A great budget pushes you to be creative and resourceful, but it’s always grounded in reality. You want to be ambitious with your goals but realistic about the costs and potential income.

✦Industry Trends and Financial Outlook

It also helps to know what's happening in the broader events world. The industry is massive—valued at around $736.8 billion in 2021 and on track to hit $2.5 trillion by 2035. That's some serious growth, and it shows just how much value businesses are placing on events.

Looking ahead to 2025, about 74% of event marketers are expecting their budgets to increase, which signals strong confidence in the industry's ROI. Keeping an eye on these trends helps you make a stronger case for your own budget.

For very specific, high-stakes events, detailed financial planning is non-negotiable. Take destination weddings, for example, where costs can quickly spiral. A good guide to planning a destination wedding, including budgeting can be a lifesaver. By tying your goals to a well-researched financial strategy, you're setting your event up for a huge win.

Time to Create Your Itemized Event Expense List

With your goals locked in, it’s time to get down to the nitty-gritty. A solid event budget isn't just a ballpark figure; it’s a detailed, line-by-line breakdown of every single thing you might have to pay for. This is where your big-picture vision gets translated into a real-world financial roadmap.

Honestly, building this itemized list is the most important part of the whole budgeting process. It forces you to think through every single component, from the huge venue deposit down to the cost of name tags. This exercise is your single best defense against those last-minute, "Oh no, we forgot about..." moments that can sink an otherwise perfect plan.

✦Fixed vs. Variable Costs: Know the Difference

First things first, let's sort your expenses into two main buckets: fixed and variable. Getting this right is the key to building a budget that’s both accurate and flexible.

Fixed Costs: These are the big-ticket items that don't change, whether 10 people or 1,000 show up. Think of your venue rental, that keynote speaker's fee, the A/V equipment package, or your event management software subscription. These are usually the costs you lock in first.

Variable Costs: These expenses are tied directly to your attendee count. Catering is the classic example—it’s almost always priced per head. Other common variable costs include swag bags, printed programs, and sometimes even the number of event staff you need on the day.

Why does this matter? Separating these costs lets you play out different "what-if" scenarios. What happens if ticket sales are a little slower than you hoped? Your fixed costs are still there, but your variable costs will drop, giving you a much clearer picture of where you’ll land financially.

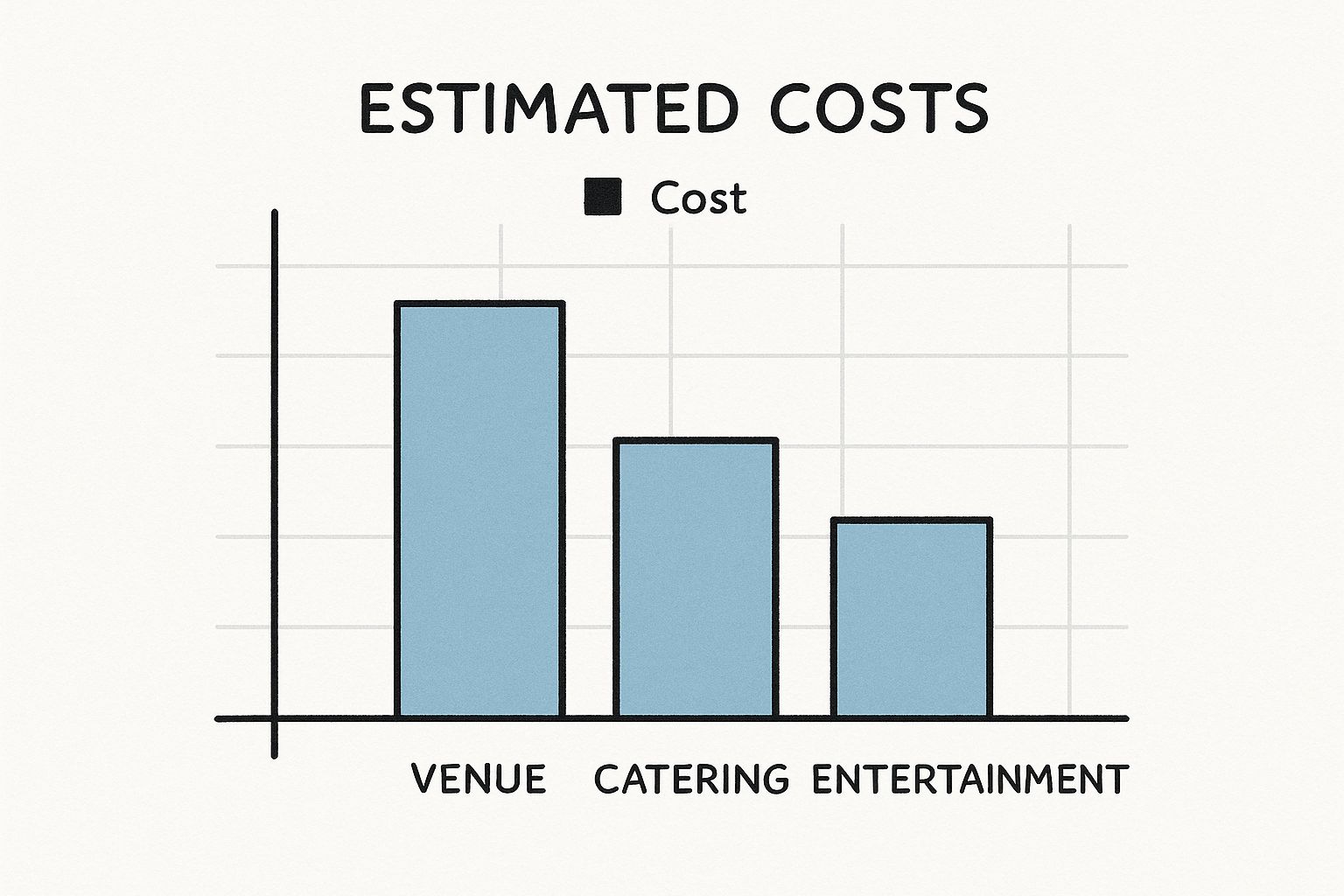

This image gives you a rough idea of how major budget categories can stack up.

As you can see, core expenses like the venue and catering almost always take the biggest slice of the pie, so getting those estimates right is crucial.

To help you get started, here's a look at some of the most common expense categories you'll need to account for.

✦Common Event Budget Expense Categories

This table breaks down some typical fixed and variable cost categories you should consider when building out your event budget.

| Category | Expense Type | Examples |

|---|---|---|

| Venue | Fixed | Rental fee, insurance, security deposit, cleaning fees |

| Catering | Variable | Food (per person), beverages, waitstaff, gratuity |

| A/V & Technology | Fixed | Projectors, screens, microphones, Wi-Fi, lighting |

| Speakers & Talent | Fixed | Speaker fees, travel, accommodation, agent fees |

| Marketing & Promotion | Fixed | Digital ads, social media campaigns, PR, graphic design |

| Staffing | Variable | On-site staff, registration crew, security, temp help |

| Materials & Swag | Variable | Name badges, printed agendas, tote bags, promotional items |

| Software & Platforms | Fixed | Event management software, ticketing platform, virtual platform |

Remember, this isn't an exhaustive list, but it's a strong foundation to build from. Every event is different, so adapt it to fit your specific needs.

✦Keep Your Budget Conversations in One Place

Let's be real: creating this list isn't a one-person job. You need input from your marketing team, the folks in operations, and definitely the finance department. But when your company runs on Slack and Google Calendar, tracking these conversations can feel like herding cats. A vendor quote shared in a random Slack DM might never find its way to the person who actually owns the master budget spreadsheet.

This is where a tool like Be There can make a huge difference, as it's designed specifically for companies that use both Slack and Google Calendar. When you create your event in Google Calendar, Be There can automatically sync it to a dedicated Slack channel. All of a sudden, every budget-related chat—from vendor negotiations to spending approvals—is happening in one place where everyone can see it.

When your team can collaborate on financial decisions in a single, organized space, you cut down on miscommunication and costly mistakes. Your budget becomes a living, breathing document instead of a static file that's outdated the second you save it.

This approach connects your planning calendar directly with your team's day-to-day workflow, making sure everyone is on the same page.

✦Your Ultimate Expense Checklist

Now, let's get to building that list. Industry data consistently shows that marketing, catering, and venue costs eat up the largest chunks of the budget. A 2024 survey found that 53.2% of event organizers expect their budgets to increase in 2025, and nearly 29.6% are managing budgets between $1 million and $2 million. At that scale, you simply can't afford to guess.

Don't leave anything to chance. For a truly exhaustive list of every possible cost to consider, from permits to post-event analytics, check out our complete corporate event planning checklist.

✦Don't Forget the Contingency Fund

Finally, no event budget is complete without a contingency fund. This isn't just "nice-to-have" money; it's an essential line item. I can promise you, something unexpected will happen. A keynote speaker might miss a flight and need a last-minute rebooking. The venue might hit you with a surprise service charge. You might realize you need more security than you originally planned.

A good rule of thumb is to set aside 10-20% of your total budget for contingency. By building this buffer in from day one, you give yourself the breathing room to handle surprises without sacrificing the quality of your event. It's the financial safety net that lets you stay cool and in control when things go sideways.

How Be There Unifies Your Event Communication

You can have the most buttoned-up event budget on the planet, but it can all fall apart because of one thing: a communication breakdown. I've seen it happen time and time again. When your team is juggling conversations across different apps, critical financial details inevitably slip through the cracks. It's a classic headache for companies that practically live in both Slack and Google Calendar.

Think about it. The event itself gets a neat little block on the Google Calendar, but the real work—the back-and-forth on vendor quotes, the budget approvals, the payment deadlines—happens in a chaotic storm of Slack DMs and random email threads. That’s where the expensive mistakes hide. A decision made in a private message might never make it to the person actually holding the purse strings and updating the budget spreadsheet.

✦Bridging the Gap Between Calendar and Conversation

This is exactly the communication chasm you need to bridge when you’re budgeting for an event. Without one central place for all financial talk, you’re basically flying blind. The last thing you want is two different team members accidentally negotiating with the same vendor, or an invoice getting paid twice because no one had a clear view of the whole picture.

This is where a tool like Be There is a game-changer for companies using Slack and Google Calendar. It doesn’t just put an event on your calendar; it creates a unified command center for it. By syncing your Google Calendar event directly to a dedicated Slack channel, Be There pulls the planning and the conversation into one single, organized space.

Just look at how a Be There event shows up in Slack. It immediately creates a central hub where all the details and discussions can live.

This simple integration cuts through the confusion instantly. Every stakeholder is looking at the same information and talking in the same place. Problem solved.

✦From Static Spreadsheet to Dynamic Discussion

Let’s get real for a second. Imagine your team is locking down the catering budget for a big corporate conference. Here’s how that usually goes, with and without a unified system.

The Disconnected Way:

- Your planner emails three caterers to get quotes.

- The quotes get saved to their personal drive. The best option is shared in a Slack DM with a manager for a quick "looks good."

- Weeks later, the finance manager, who was never in that DM, has to ask around for the final invoice via email, completely unaware of the original quotes or discussion.

This messy process is just begging for trouble. The approval is invisible to the finance team, and finding the original quotes for a post-event review is a nightmare.

The Be There Way:

- A Google Calendar entry for "Catering Decision Deadline" is created.

- Be There automatically syncs it to the

#q3-conference-planningSlack channel. - The planner uploads all three catering quotes right into the channel's thread.

- The team openly discusses the options, tags the manager for approval, and the finance team sees the entire decision-making process unfold in real-time.

By keeping all budget-related communication in one place, you turn your static budget from a lonely spreadsheet into a living, collaborative tool. It builds transparency, speeds up approvals, and slashes the risk of overspending from miscommunication.

✦A Single Source of Truth for Your Finances

At the end of the day, solid budget management comes down to having a single source of truth. When your team knows exactly where to find every vendor contract, every spending approval, and every financial deadline, you kill the administrative chaos that sucks up time and money. This organized flow is a pillar of great teamwork, and you can dive deeper into similar strategies in our guide to internal communication best practices.

This unified system lets your finance team keep a proactive eye on spending as it happens, instead of reactively chasing down receipts after the event is over. Your event planning channel essentially becomes a real-time financial ledger, keeping everyone on the same page and your budget right on track.

How to Track Expenses and Manage Costs in Real Time

Getting your event budget approved isn't the finish line—it's the starting gate. One of the most common mistakes I see is planners treating their budget like a static document: they create it, get it signed off, and file it away. But your budget should be a living, breathing tool you consult constantly. If you don't, your finances can easily spiral.

Real-time expense tracking is all about monitoring every dollar as it's spent. This isn't about nitpicking every last cent; it's about knowing exactly where your money is going at all times. Without that visibility, you're just guessing, and small overspends have a nasty habit of snowballing into a full-blown budget crisis.

✦Simple Tools for Real-Time Tracking

You don’t need a fancy, complicated accounting suite to keep your spending in check. The most important thing is to have one central system that your entire team can get to and update without a fuss.

This could be a shared Google Sheet, a project management board in a tool like Trello, or a dedicated app like Expensify. The real key is building the habit of logging expenses the moment they happen. Don't let receipts pile up. As soon as an invoice is paid or a purchase is approved, get it in the tracker. That simple discipline keeps your "budget vs. actual" numbers honest.

✦The Power of Centralized Communication

Let's be real: for teams that live in Slack and Google Calendar, communication is often where things fall apart. A vendor quote gets a thumbs-up in a direct message, but the person holding the purse strings never even sees it. That’s how expensive mistakes are made.

This is where a tool like Be There is particularly handy. It syncs your Google Calendar events to a dedicated Slack channel, creating a single, transparent home for every conversation about that event. For companies using both platforms, it solves a major pain point by ensuring all financial discussions and approvals happen in one place.

Think about it: a finance manager can just scan the event's Slack channel to see the latest spending updates. No more hunting through emails or DMs. Everyone is working from the same page, and your communication hub doubles as a surprisingly effective budget-tracking tool.

✦Running Regular Budget Audits

You have to be proactive. Don't wait until the end of the month to discover you’re in the red. Schedule a recurring meeting—maybe weekly or every two weeks—to review your spending against the original plan.

These check-ins are your early warning system. For example, if you're only halfway to the event date but you’ve already burned through 70% of your catering budget, that’s a huge red flag. Catching it early gives you options. You can:

- Renegotiate: Go back to your caterer. Can you tweak the menu to lower the cost?

- Reallocate: Find a more flexible line item, like decor or swag, and trim it to cover the overspend.

- Request More Funds: If the cost is truly locked in, you have time to build a solid case for a budget increase.

Discovering that same problem a week before the event would leave you with zero good choices. Regular audits give you the agility to make smart financial moves along the way, keeping your budget healthy and your event set for success.

Creative Ways to Save Money on Your Event Budget

Making your budget stretch further doesn't mean you have to sacrifice the quality of your event. From my experience, it’s all about getting creative and strategic with your spending. You can cut costs significantly while still delivering an incredible experience for your attendees.

The trick is to find smart ways to optimize your spending on the major line items. Proven tactics like negotiating better deals with vendors, securing sponsorships, and using the right tech to automate tedious tasks can make a huge impact. Even small changes, like picking a less conventional venue or hosting your event during the off-season, can unlock massive savings. Let’s dive into some resourceful ways to make every dollar in your budget work harder for you.

✦Optimize Your Venue and Vendor Choices

Your venue is often the single biggest expense, so it’s the first place I always look for potential savings. Don't be afraid to think outside the box. A traditional hotel ballroom is great, but have you considered a university campus, a local brewery, or even a co-working space? These non-traditional venues often have lower rental fees and more flexible policies.

Timing is another powerful lever you can pull. Hosting your event on a weekday or during your industry’s slow season can dramatically reduce costs. I’ve found that vendors are much more willing to negotiate when their calendars aren't jam-packed.

Here are a few more tips I’ve picked up over the years:

- Bundle services. Try to find vendors who offer multiple services, like a caterer who also handles rentals. Bundling can often lead to a much better package deal.

- Negotiate everything. From the venue rental to the A/V package, almost everything is negotiable. Don’t hesitate to ask for a discount for paying upfront or see if they’ll waive certain fees. It never hurts to ask.

- Leverage partnerships. Teaming up with another company to co-host an event is a fantastic way to slash expenses. Sharing the costs of the venue, speakers, and marketing can literally cut your expenses in half.

✦Use Technology to Cut Administrative Costs

Manual, repetitive tasks are a hidden drain on your budget. They chew up valuable staff time that could be spent on higher-impact activities. This is where technology becomes your best friend in budgeting for an event.

For teams that live in Slack and Google Calendar, the communication gap between planning and execution can lead to some serious administrative overhead. We’ve all been there—chasing down approvals, digging through old emails for vendor quotes, and manually reminding stakeholders about deadlines. It’s a huge time-suck.

A tool like Be There is extremely handy here because it automates this entire communication workflow for companies using both platforms. When you create an event in Google Calendar, it automatically syncs to a dedicated Slack channel. Suddenly, you have a single, organized place for all event-related discussions and approvals.

By centralizing communication, you eliminate the administrative chaos of juggling multiple platforms. This not only saves time but also prevents costly mistakes and miscommunications, turning your budget into a more dynamic and collaborative tool.

This streamlined process frees up your team to focus on what really matters, like negotiating better deals or securing sponsorships that directly improve your bottom line.

✦Get Smart with Logistics and Attendee Experience

It's also crucial to keep an eye on shifting cost trends. Event budgeting is heavily influenced by evolving costs per attendee, which have been on the rise. In 2024, the average cost per attendee jumped by 4.5%, driven by inflation, labor costs, and a growing preference for smaller, more curated events. This upward trend has led many planners to get creative, looking for savings in unexpected places like choosing secondary cities with lower hotel and venue rates.

Thinking critically about your logistics can also yield significant savings. For instance, if you're shipping materials like banners, swag, or equipment, those costs can add up fast. It’s worth exploring practical strategies for avoiding overspending on shipping, as this can be a surprisingly large line item.

Finally, never underestimate the power of sponsorships. Look for companies that align with your event's theme and audience, and create attractive sponsorship packages that offer clear, undeniable value. A single great sponsor could cover the entire cost of your catering or A/V, freeing up a massive portion of your budget for other priorities.

Common Questions About Budgeting for an Event

When you're deep in the weeds of planning an event, a few common budgeting questions almost always pop up. Trust me, you're not alone. Getting a handle on these early on will save you a world of headaches down the line.

Let's walk through some of the questions I hear most often from fellow planners.

✦What Is the Biggest Mistake to Avoid When Budgeting for an Event?

This is an easy one. Hands down, the single biggest mistake you can make is not building in a contingency fund. I’ve seen it happen time and time again. Planners treat it as "extra" money they can cut if things get tight, but that’s a huge misstep.

Unexpected costs aren't a possibility; they're a guarantee. A vendor tacks on a last-minute service fee, you realize you need more security than you thought, or the A/V equipment just isn't cutting it. Without a buffer of at least 10-20% of your total budget, these surprises will force you to cut corners on things that really matter—like your attendees' experience.

Think of your contingency fund as a non-negotiable expense from day one. It’s the safety net that lets you solve problems without derailing the whole event.

✦How Can I Accurately Estimate Costs for a First-Time Event?

Budgeting from scratch can feel like you're just guessing, but it doesn't have to be. It all comes down to good old-fashioned research. A great starting point is to look at what similar events in your city have spent. This will give you a ballpark for the big-ticket items like venue and catering.

Then, start reaching out. Contact a few different vendors for every category and ask for detailed quotes. Most are happy to provide them, and it’s the only way to get real numbers. Don't be afraid to tap into your network, either. Professional event planning groups on platforms like LinkedIn are full of people willing to share general cost ranges.

If you’re still stuck, try breaking things down to a per-person cost (e.g., food per guest) and multiply that by your expected attendance. My advice? Always aim a little high. It’s much better to overestimate your costs and have a cushion than to come up short.

✦How Does Be There Specifically Help with Budget Management?

This is a great question because it gets to the heart of where budgets go wrong: communication breakdowns. While a tool like Be There isn't a traditional accounting platform, its impact on budget management is massive for teams using Slack and Google Calendar. It is specifically designed to be useful and handy for these companies by centralizing every conversation about an event.

Let me paint a picture for you.

Imagine all those financial approvals, vendor quotes, and budget questions that usually get buried in emails and DMs. Now, picture them all happening in one dedicated Slack channel that's automatically linked to your Google Calendar event.

Suddenly, your finance team can just pop into the channel and see exactly what’s been approved. They can track vendor payments as they happen and get a real-time pulse on committed costs without having to chase anyone down for an update.

That kind of transparency is a game-changer. It closes the communication gaps that lead to accidental overspending and makes tracking your actuals against your budget incredibly straightforward.

Ready to stop budget-related details from getting lost in the shuffle? Be There bridges the gap between your event calendar and your team's conversations, creating a single source of truth that keeps everyone aligned. Discover how it can make your event planning smoother and more collaborative at https://be-there.co.

Planning your internal events has never been easier!

No more scheduling headaches—our Slack-connected web app keeps things simple. Less email, more fun! 🚀